By looking at the pure data, the numbers would indicate that air cargo volumes have not just returned to pre-Covid levels but, in fact. the industry has moved on beyond them, with the last six months showing double-digit growth compared to 2023.

But this then generates several often-asked questions; Where is the business coming from? Will it continue? What will happen in Q4? Is it all e-commerce? The answers to those questions are not easily addressed.

What we do know

November 2023 saw Houthis in Yemen announce they would attack commercial ships associated with Israel, the US and Europe sailing through the Red sea in response to Israel’s military action in Gaza. Up to the middle of July, Bloomberg reported that there have been over 65 reported incidents with 18 ships having been struck with missiles. Despite military action targeting the missile launch sites, the attacks continue.

Maritime analysts and risk assessors suggest that the attacks will likely to continue for the remainder of 2024 and into 2025. Maritime operators have stressed they will not return to the shorter more efficient Red Sea shipping lanes until it is safe to do so for crew and cargo.

The consequential impact on journey times from Asia to Europe and on overall shipping costs has resulted in the narrowing of air cargo / maritime differentials. A more competitive air cargo industry results in increased volumes. Shortages in shipping containers also promote a shift to air cargo.

The global economy

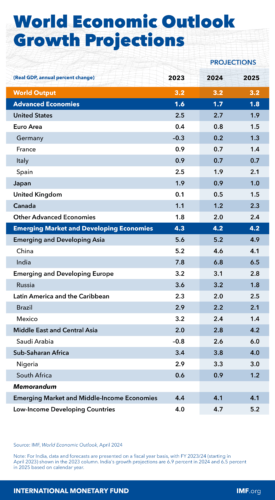

According to the latest analysis from the IMF the global economy continues to improve:

Major economies are becoming more aligned, but the world’s medium-term prospects remain weak. Our (IMF) global growth projections are unchanged at 3.2 percent this year and slightly higher at 3.3 percent for next year, but there have been notable developments beneath the surface since the April World Economic Outlook.

The IMF forecast indicates that growth in major advanced economies is becoming more aligned as output gaps are closing. The United States shows increasing signs of cooling, especially in the labour market, after a strong 2023. Meanwhile, the Euro area is poised to pick up after a nearly flat performance last year.

With Asia’s emerging market economies remaining the main engine for the global economy, it bodes well for air cargo growth. GDP forecasts for India and China have also been revised upwards and accounts for almost half of global growth.

With this backdrop, the IMF has revised its GDP forecast for 2024/25.

With global economic prospects looking favourable, we can expect the demand for traditional air cargo commodities to remain strong for the remainder of 2024 and into 2025.

Is it all online shopping?

e-commerce accelerated exponentially during Covid-19, as global consumer bases were restricted to shopping from home. This new wave of consumer activity has continued on its growth trajectory and today accounts for about 20 percent of total air cargo volumes. This number is projected to grow to about 30 percent by the end of the decade.

It is estimated that e-commerce accounts for about the equivalent of 100 747s of capacity each day.

This brings a new type of demand for operational processes with speed, transparency, integration with first and last delivery mechanisms playing an increasingly important role.

In addition to e-commerce growth, pharmaceutical shipments are growing steadily as more people around the world embrace modern medicine with personalised healthcare based on individual treatment programs expected to increase further in coming years.

Perishables, including fresh meat, fruits, vegetables and flowers have also shown strong resilience and growth with enhanced focus on eliminating waste and spoilage throughout the supply chain.

Production and manufacturing centres have also seen some shifts with supply chain de-risking strategies being deployed. China continues to be the main centre of global manufacturing, but significant investment has been made into India, Mexico, Vietnam and other areas in Southeast Asia, as well as some other instances of near or friend shoring. As production centres fragment, the need for air cargo and maritime supply chains increases to smooth out this new complexity.

Its also worth noting that the affluent global middle-class community has grown by several hundred million people in the last five years, predominantly in Asia, and they collectively bring additional demand for the consumer goods, which are the mainstay of air cargo movements.

In conclusion, the prospects for full year air cargo growth in 2024 look exceptionally promising, although perhaps we may see year-over-year comparisons slowing as we get into Q4.

Capacity could become tight as peak period in Q3 is already seeing some advance contracts being signed.

Going forward, the industry must ensure that air cargo in 2024 and beyond continues to evolve as the global economic conditions evolve. Efficient operations require embracing technology at a greater pace than previously and infrastructure must continue to be invested in to meet the increasingly sophisticated needs of today’s cargo.